why use an llc for a rental property

What Are the Benefits of Creating an LLC for Your Rental Property. Its purpose is to restore the rental property to the earlier condition when you moved in.

Should You Create An Llc For Your Rental Property Allbetter

What does this mean exactly.

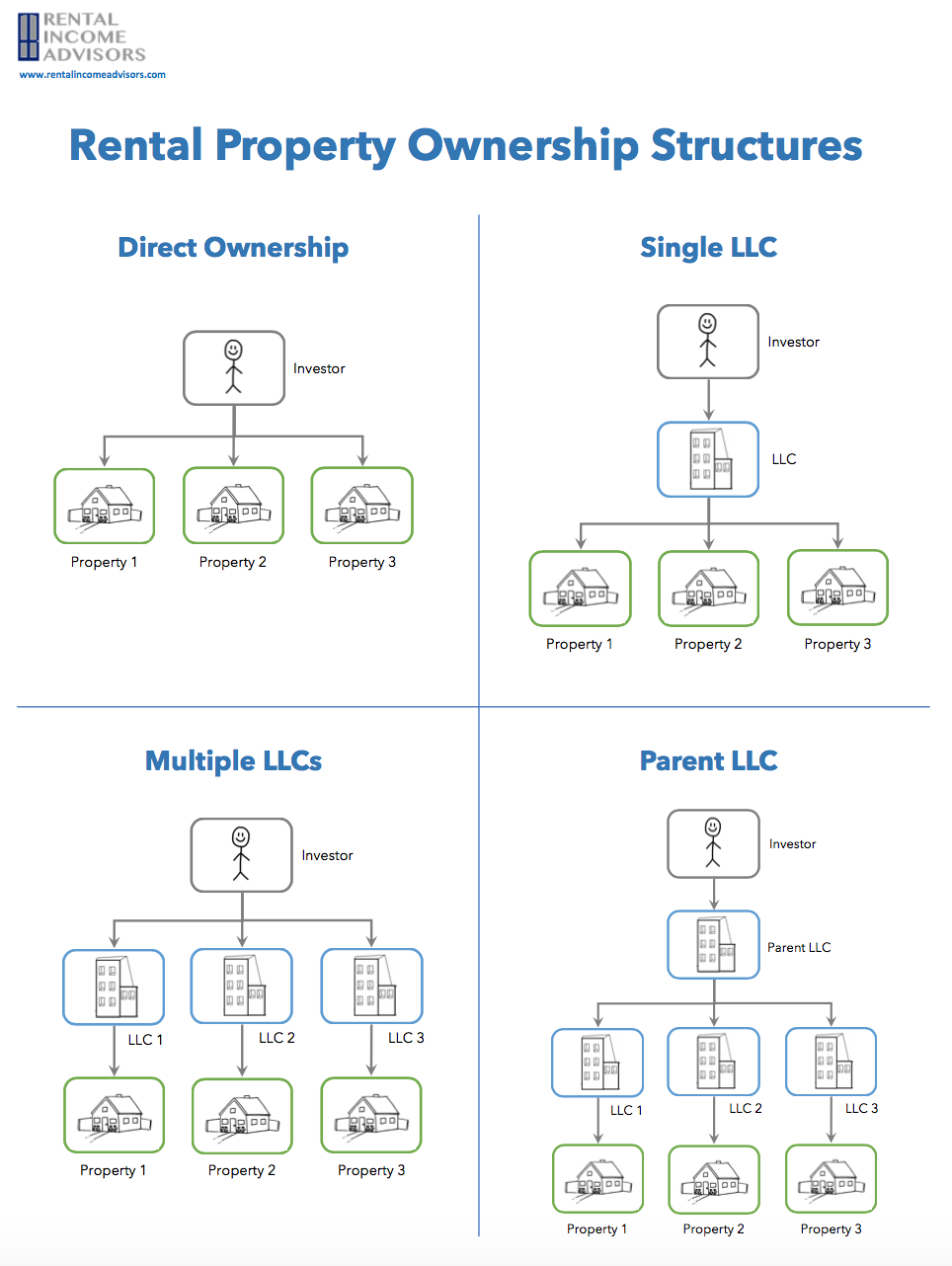

. Read on to learn why you should put your rental property into an llc. Only if you clean your building at the. Some investors have one LLC per property and others have 20 properties in one LLC.

It makes things cleaner from a financing and tax perspective to write them off under an LLC. Having said that generally speaking isolating liability is a good idea. If you dont plan to use an LLC do whatever you can to keep your investments.

Benefits of Creating an LLC. The main benefits of llc for rental property are being able to limit your personal liability and keeping your properties. If you own your property as an individual and someone files a lawsuit.

One of the biggest benefits of holding your rental property in an LLC is for asset protection if anything happens with the property you wont be personally liable. Setting up a bank. Another argument I hear is that an LLC is the best way to keep your rental property expenses and finances separate from your personal finances.

Theres a good reason LLCs are attractive to real estate investors. The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. One of the most important reasons to consider an LLC is to limit your personal liability for your rental property.

So it should be as clean and neat as possible. Youll want to assess. Yes you may have liability insurance.

Say a tenant was to file a. Members can be paid more or less than. What is an LLC.

Limit Your Personal Liability. The Balance defines a Limited Liability Company or LLC as a hybrid type of business structure that shares the characteristics of a corporation partnership. Many property owners decide to create an LLC for their.

Holding a rental property under an LLC may help to protect the personal assets of an investor in the. While I certainly agree that you. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company will pay each owner.

When using the LLC structure for a rental property there are zero restrictions in place regarding how the company. They offer both asset protection and tax advantages. Benefits of an LLC for Rental Property.

Keep your rental properties separate from each other. An LLC also makes it easy for your property. If you own a rental property in a different state forming an LLC allows you to avoid a lengthier more expensive paperwork process.

Once you have set up an LLC for your rental property you must be careful not to commingle any of the money earned through the LLC with your own personal money.

What To Know Before Creating An Llc For A Rental Property

Options For Rental Property Llc Mortgage Other Llc Mortgages

Should You Put Your Rental Property In An Llc Thinkglink

How To Create An Llc For A Rental Property With Pictures

How To Get A Mortgage For Llc Owned Properties

What Are The Pros Cons Of Using An Llc For Rental Property

Should You Form An Llc For Your Rental Property Tellus Talk

Why You Should Form An Llc For Your Rental Property

How To Put Rental Property In An Llc And Why You Should Eforms Learn

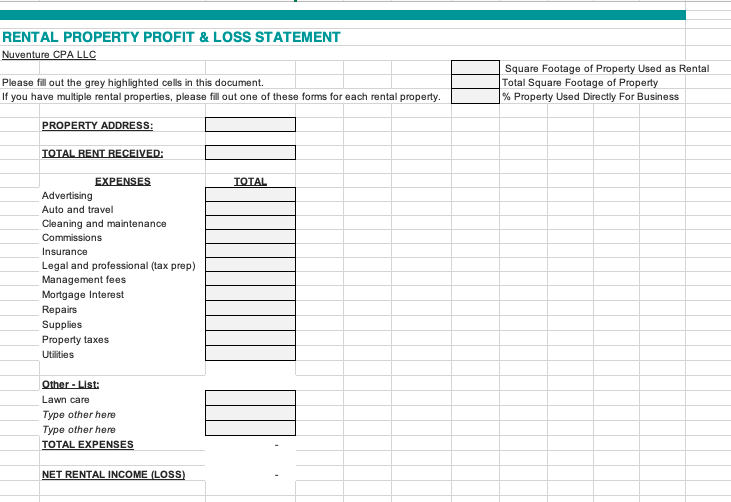

Rental Property Profit Loss Statement For Clients Nuventure Cpa Llc

Llc In Real Estate Pros And Cons Nestapple New York

Do I Need An Llc For My Rental Property Tax Q A Youtube

How To Use An Llc For Rental Property Tax Benefits More

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Reasons Not To Use An Llc For Rental Property Biggerpockets Blog

Llc For Rental Property Pros Cons Explained Simplifyllc

Llc For Rental Property Benefits And Disadvantages Honeycomb

Llc For Rental Property What Should Real Estate Investors Do